BLET

Accident Insurance

BLET Accident INSURANCE

MEDICAL EXPENSE PROTECTION PLAN

Enrolling in these benefits can help offset out-of-pocket medical expenses you may incur after an accident. Benefits are paid tax-fee directly to you. Enrolling is easy and coverages are guaranteed approved for all actively working/dues paying Members, Officers and Employees of the BLET.

Plan Information

Benefits are made available to full time, actively working Members, Officers, and Employees of the BLET.

Accident Coverage Benefits:

– Guaranteed approved, you cannot be denied coverage!

– Coverage available to member, spouse and/or child(ren)

– Lump sum benefits paid when an accident occurs.

– No limit on number of claims that can be filed.

– $50,000 of AD&D Coverage

– Monthly cost never changes, you can take coverage with you after you retire.

– Wellness Benefit ($50 per covered person).

Covered Injuries Include:

Fractures, Burns, Concussion, Dislocation, Torn Ligament, Lacerations, and others.

Covered Services Include:

Ambulance, ER visit, X-ray, MRI, Surgery, Anesthesia, Wheelchairs, Crutches, Casts, and others.

Accident Benefits & Costs

| COVERAGE | MONTHLY COSTS | |||||||||

| Members/Officers | $17.77 | |||||||||

| Members/Officers & Spouse | $26.23 | |||||||||

| Members/Officers & Child | $30.36 | |||||||||

| Family | $38.82 | |||||||||

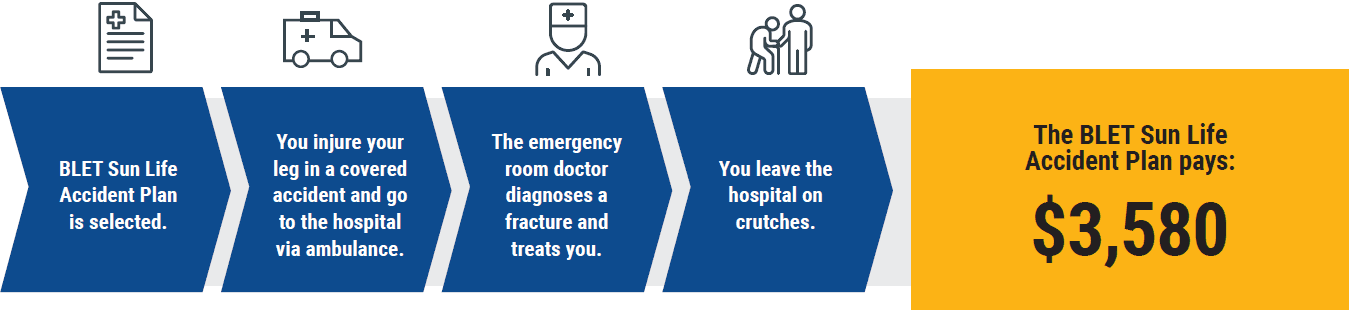

HOW DOES ACCIDENT INSURANCE WORK?

Amount payable was generated based on benefit amounts for: Closed-Fracture of the Thigh ($3,000), Ambulance to Hospital ($200), Emergency Room Admission ($200), X-Ray ($30), Medical Devices (crutches) ($100), and Physician Follow-Up ($50).

Participant and Claimant Responsibilities

It is your responsibility to notify Union One if your employment, union status, contact information, or salary changes. Failure to properly notify Union One will result in loss of monthly payments and/or insurance coverage. Notification to Union One must be made by phone at (224) 770−5307 and/or by email at info@bletinsurance.com.

As an individual Member of the union, if you have voluntarily elected to participate and pay monthly costs for coverage, it is your responsibility to understand the group policy and its provisions.

Monthly Cost Payments, Calculations and Adjustments

Loss of Monthly Cost Notice

If you do not contact our office within 90 days of your date of dismissal, date of retirement, date in which you left the BLET, there will be no refund for any monthly cost paid. It is the sole responsibility of the Member to contact Union One at (224) 770−5307 or by email at info@bletinsurance.com within the 90 day allotted time.

Failure to Make a Payment

Participating Members for whatever reason may miss a monthly payment from time to time. The current plan allows for a 60 day grace period to make up any missed monthly payments.

Administrative & Transaction Costs

All administrative and transaction fees are included in your monthly payment. These fees cover the costs associated with, but not limited to, monthly cost processing, monthly cost returns, postage, policy correspondence, claims advocacy and other ancillary expenses associated with the administration of your elections. These monthly fees are applied to all coverages shown on the Summary of Benefits & Rates.

Included when monthly total is collected: Payment Transaction Fee 1.00 per transaction.

IMPORTANT

If you leave the union for any reason other than retirement, you are no longer eligible for coverage and it is your responsibility to contact our office immediately at (224) 770-5307. Failure to do so within 90 days will postpone your ability to receive a refund.

This program is voluntary and it is solely the Members’ decision to enroll. Members are responsible for paying their own costs. The BLET does not make any endorsement or recommendations regarding these benefits. Please note that coverage is for BLET members, officers and employees only. This is a basic summary of benefits and makes no guarantee or warranty on the processing of claims. In order to be eligible for benefits at time of claim, you must be an active member, officer or employee of the BLET or retired from the BLET. Other limitations may apply. It is the responsibility of each enrolled Member to obtain a copy and read the entire policy booklet. A copy of the policy booklet will be available on the plan website www.bletinsurance.com or you may request a copy of the policy booklet by email to info@bletinsurance.com. All non-banking administrative and transaction fees are included in the enclosed costs.